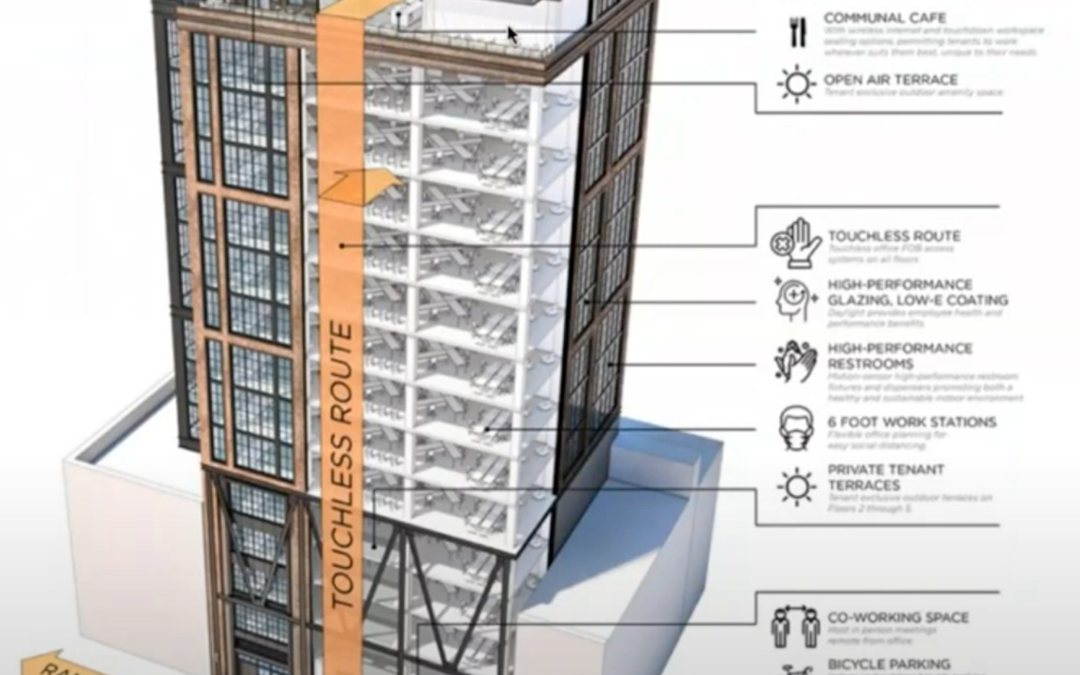

Here in Chicago, we see big developers putting up new high rise apartments towers, condos and office buildings like crazy right now.

There’s incredible pent up demand for new construction and when you combine that with historically low interest rates, you have a perfect climate to build new projects.

My new book Don’t Buy Multi-Family! BUILD IT tells investors how they can join the party and why now is the best time ever to do it!

I see so many people trying to invest in multi family income property right now, only to find that they are just not interested in any of the properties that are on the market. There is more and more competition to buy properties that are really marginal investments at best.

I’ve been in real estate and development for 35 years now and I’ve never seen a better time for investors to build new construction investment properties.

This book will show you how to do it. There’s a link below to get the book on Amazon.

https://www.amazon.com/gp/product/B09PSFMC6Z/

And If you’re an ebook reader, there’s even a special $1.99 intro price on the ebook right now!

If you subscribe to follow this channel, In the coming days and weeks, I’ll be posting videos with more detailed information and examples from the book to show you how to find and recognize a great investment deal when you see one!

If you have more specific questions, you can reply here, or refer to our web site http://ld2development.com